11 Pitfalls All Graduating Residents and Fellows Should Avoid

Congrats, you did it! You finally finished your medical training! After years of being a doctor who, per hours worked, earned less than minimum wage, (for some of you it’s been 10 years: you know who you are…), you are moments away from beginning your actual career as an ATTENDING physician. Finally, it’s time to get paid!

Or so you think.

In my business I have seen the many financial mistakes young physicians make at the beginning of their practice. These decisions can lead to major financial setbacks in a short amount of time. I often wish I could have met with them at their graduation to help them avoid these pitfalls and guide them in the right direction. One of our good friends from residency explained it best when after 3 years as an attending surgeon he said, “I don’t get it: I MAKE a lot of money, but I never seem to HAVE a lot of money.” If you do not want to be saying these words a few years from now, continue reading.

#1. Student Loan Negligence

I’ve written quite a bit about student loans, and for good reason. The average medical student graduates with $189,000 of debt. Yet, there is very little education in how to deal with it. The debt isn’t just going to take care of itself. And the absolute worst thing you can do is stay the course with your high interest loans from residency with no loan forgiveness in sight. You need to have a plan of attack. This means going through the process to ensure you will qualify for Public Service Loan Forgiveness which includes having the right kind of student loans, enrolling in the correct income-driven plan, and annually certifying your employment. If you aren’t pursuing PSLF, make sure you are budgeting appropriately to refinance your loans at a low rate and pay them back within 5-10 years. It’s best to have this planned out even before you finish training, but if you haven’t, address it immediately so that you aren’t 120 payments in before realizing you have been in the wrong type of loan or your employer doesn’t qualify.

#2. House Poverty

The biggest key to financial success is the ability to save money. Your target savings rate should be 20% of your gross income. So, why are many physicians unable to do that? Simple: right after training, they bought and furnished the house of their dreams and have 25% of their monthly budget going towards housing. I admit, it is tempting. You have spent the past 7-12 years of your life studying, broke and living in a dingy apartment. No one can blame you for being ready to move up in the world. But if you are with the majority of physicians who come out of training with massive student loan debt (see #1), consider waiting a year or two after working before you buy your dream house. If you can afford a house up front and still manage to save 20% of your income, have at it. If you can’t afford it but already bought it, you’ll need to find a way to reduce your expenses (see #5).

#3. Security in Insurance

Insurance agents prey on young doctors. You probably encountered a few of them when they gave presentations at your medical school. It all sounded very intelligent and made you feel like you weren’t secure unless you bought a Whole Life Policy and a Variable Annuity. They may have even branded these policies with labels promising stock market returns and no downside. Doesn’t it sound magical? Just like unicorns, these returns do not exist. They will help your insurance agent retire, because they are loaded with commissions and fees, but in reality, investing in these policies will result in delaying your financial well-being.

That said, I am a big believer in insurance: that is, the right kind of insurance. Disability and umbrella policies are a must for every graduating fellow. If you have any dependents, a term life policy is also critical until you reach financial independence. Just be careful when something seems too good to be true. Use insurance as protection, not an investment.

#4. Not Maxing on Retirement Accounts

The IRS limits how much we can invest in tax-deferred accounts in a year. If you aren’t maximizing all of these avenues (401(k), Backdoor Roth IRA, Health Savings Account, or possibly even a Solo-K), you are cheating yourself. The most common reasons for not filling up your retirement accounts are overspending, lack of understanding, investing in the wrong things (insurance, individual stocks), or overprioritizing paying off debt.

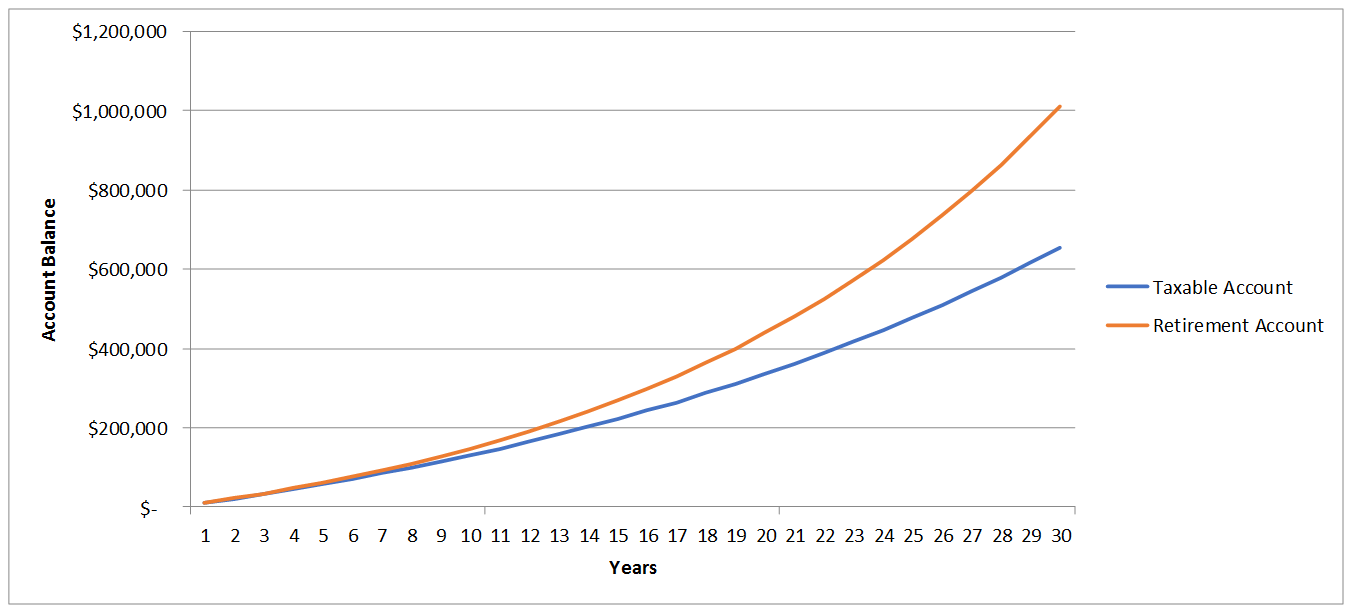

Why is this so important? Let’s look at an example of someone saving $10,000 per year for retirement in two scenarios. The blue scenario assumes the investor contributed only to a taxable account. The red scenario assumes the funds went to a tax-deferred retirement account:

In the first few years, you can’t really tell a difference, but after 30 years, the retirement account has almost an extra $400,000 dollars in it. If you want to retire sooner, stay on the red line.

#5. Lifestyle Inflation (Mo Money, Mo Problems)

Overspending on things other than your house is the second biggest barrier to saving at least 20% of your income. Don’t be the new attending with the $200,000 car and the $5,000 retirement account. Cars are not the only pitfall, though. Restaurants, vacations and entertainment can also add up. Obviously, you can afford a fancy dinner and some professional clothes now and definitely should not deprive yourself of all things nice just to save some money. But there is a difference between a couple of nice dinners and suits and hitting up every new restaurant in town while following the Hamilton Tour across the country. Look at your spending and understand how much you are saving every month. Even though your salary has increased, there will always be financial trade-offs in life. Your goal should be to find that happy spending balance.

#6. Trusting the Salesman

Similar to the insurance agent, the “financial advisor” seems like a really nice guy that has your best interest at heart. He may have even managed your parents’ money for several years. However, beware of the wolf in sheep’s clothing! Often times, people don’t realize that they have hired a salesman instead of an advisor. What’s the difference? An advisor gets paid for their advice while a broker or sales person gets paid a commission for recommending mutual funds or investment products. If that seems like a conflict of interest, or all-around shadiness, you are dead on. Look for a fee-only planner that acts as a fiduciary (they are paid for their advice and not by commissions). This means the advisor is responsible for acting in your best interest.

#7. Trying to Time the Market

This concept comes in many different forms:

- It’s not a good time to invest because the market is at a new high.

- I need to sell before I lose any more money

- You have to cut your losses and let your winners run

- I don’t want my portfolio to go down

This topic can easily be a whole blog in itself (look for it soon). But for now, what do they all have in common? They assume that a person can figure out what the market is going to do next. So when considering investing your money, remember:

It’s the time in the market, not timing the market, that matters.

#8. Divorce

A retiring physician once told me that the keys to retirement and financial stability are: one job, one spouse, one house. He himself admitted he was successful in only one out of the three keys which is why he was retiring at a much later age than originally intended. There is a lot of emotional and spiritual discussion that could be had around this topic. For the sake of this article, though, focus on the number “½” because that’s what you will have left after a divorce. Even with a prenup, people are shocked by all the hidden costs that come with divorce (attorney fees, alimony, child support, etc). So, all of that hard work in planning and saving can and will go down the drain with the marriage. Ways to avoid this? Well, if you’re thinking about getting married, really make sure this is the person you want to spend the rest of your life with. If you’re already married, try to stay married (obviously, I’m pro-marriage). If divorce has to happen, seek out help to minimize your losses.

#9. The HOT NOW Investment

It seems like kind of a joke now, but last winter every person I would talk to was asking me if they should invest in Bitcoin. Bubbles are always easy to see in hindsight, but I literally had other CFA Charterholders telling me I should be including Bitcoin in my clients’ portfolios (spoiler alert: I did not). In 2005-2007 the hot investment was real estate. In the late 90’s it was tech stocks. See the pattern? In each of these cases prices skyrocketed when those who feared missing out jumped on the bandwagon. When prices just as quickly dropped, panic ensued, and the hot investment turned cold. Avoid this trap by placing the majority of your investments in several asset classes that have stood the test of time.

#10. Taking Your Buddy’s Tax Advice

The story usually starts with “A colleague of mine set up a S-Corp for his practice to save on Medicare taxes…” But practicing medicine for 10 years doesn’t really make your senior partner an expert in tax planning so why are you taking his advice?Would you recommend I take medical advice from a financial planner?

A common mistake I see is setting up an S-Corp to save a few dollars of Medicare taxes. This is often done without realizing the additional cost associated with payroll, tax returns, and even the changes to the tax code.

So, before you jump off the S-Corp bridge, make sure you are understanding the repercussions of your decisions and getting personalized advice from a qualified professional.

#11. The DIY Investor

This one I know is going to be a little controversial. There are several do-it yourself investors out there that put in the time and research to manage their own investments. The vast majority of investors are far too busy to really become skilled in investment management. Yes, they may manage their own money, but there isn’t a plan. They construct portfolios using and investment article or two and feel like they are on set. They tend to have no idea how risky their portfolios are, which asset classes they are invested in, or even what their investment goals are. If you are going to go the do-it yourself route, you must be willing to do your homework.

In Summary

The key to financial success really isn’t that complicated. Be educated on your loans, don’t spend more than you earn, have a financial plan, keep your tax bill low, and invest in proven assets. I hope that this article helps you spot a shady financial salesperson from a mile away and can avoid being sold a product you don’t need. Congratulations on a job well done! Now that you know the financial pitfalls to avoid, you can focus on what is really important – your patients.